Bob Hope once said, “I’m so old they’ve canceled my blood type!” Let’s take a look at some of the best aging jokes below.

Best Jokes About Aging

1. “It’s not that I’m afraid to die, I just don’t want to be there when it happens.” – Woody Allen

2. “Talk about getting old. I was getting dressed and a peeping tom looked in the window, took a look and pulled down the shade.” – Joan Rivers

3. “People ask me what I’d most appreciate getting for my 87th birthday. I tell them, a paternity suit.” – George Burns

4. “The first sign of maturity is the discovery that the volume knob also turns to the left.” – Jerry M Right

5. “Middle age is when you still believe you’ll feel better in the morning.” – Bob Hope

6. “When I was a boy the Dead Sea was only sick.” – George Burns

7. “You can live to be a hundred if you give up all the things that make you want to live to be a hundred.” – Woody Allen

8. “There is no pleasure worth forgoing just for an extra three years in the geriatric world.” – John Mortimer

9. “Looking 50 is great if you’re 60.” – Joan Rivers

10. “The terror is to wake up one morning and discover that your high school class is running the country.” – Kurt Vonnegut

11. “How young can you die of old age?” – Steven Wright

12. “By the time a man is wise enough to watch his step, he’s too old to go anywhere.” – Billy Crystal

13. “So far, this is the oldest I’ve been.” – George Carlin

14. “Whatever you may look like, marry a man your own age – as your beauty fades, so will his eyesight.” – Phyllis Diller

15. “You know you’re getting old when the candles cost more than the cake.” – Bob Hope

16. “As you get older, the pickings get slimmer, but the people sure don’t.” – Carrie Fisher

17. “I’ve learned that life is like a roll of toilet paper. The closer it gets to the end, the faster it goes.” – Andy Rooney

18. “As a graduate of the Zsa Zsa Gabor School of Creative mathematics, I honestly do not know how old I am.” – Erma Bombeck

19. “At my age, flowers scare me.” – George Burns

20. “My grandmother was a very tough woman. She buried three husbands and two of them were just napping.” – Rita Rudner

21. “I’m at an age when my back goes out more than I do.” – Phyllis Diller

22. “When you are dissatisfied and would like to go back to youth, think of algebra.” – Will Rogers

23. “Regular naps prevent old age, especially if you take them while driving.” – Unknown

24. “The only reason I would take up jogging is so that I could hear heavy breathing again.” – Erma Bombeck

25. “We could certainly slow the aging process down if it had to work its way through congress.” – Will Rogers

Funny Jokes On Aging

26. You’re not getting older, you’re just becoming classic.

27. Old age isn’t so bad when you consider the alternative.

28. Allow me to politely suggest this be the year you start lying about your age.

29. These are not gray hairs! They are wisdom highlights!

30. Why am I getting older and wider instead of older and wiser?

31. The older we get, the earlier it gets late.

32. What goes up but never comes down? Your age!

33. At my age, the only pole dancing I do is to hold on to the safety bar in the bathtub.

34. Aging gracefully is like the nice way of saying you’re slowly looking worse.

35. You know you’re getting older when you have a party and the neighbors don’t even realize it.

36. How are stars like false teeth? They both come out at night!

37. A very happy birthday to someone who is now taking drugs on their birthday for actual serious medical reasons.

38. At least you’re not as old as you will be next year!

39. This year, may you always get up off the couch in two tries or less.

40. Did you know that there’s a prize for getting older? Yep – you get atrophy.

41. Do you want to know the secret to having a smoking hot body at your age? Cremation.

42. Age is a relative thing. All your relatives keep reminding you how old you are.

43. Don’t let your age get you down. After all, at your age, it’s hard to get back up again.

44. This whole birthday thing is getting old, don’t you think?

45. You and wine are the perfect pair. Wine improves with age, and you improve with wine.

46. Age is a number – keep yours unlisted.

47. I’m not saying you’re old, but if you were whiskey you’d be expensive.

48. You’re so old, I heard your social security number is 3.

49. Fabulosity has no age.

50. In wine years, you are extra fine.

More Aging Jokes:

Old Age Jokes

Aging At Home

Aging And Healing

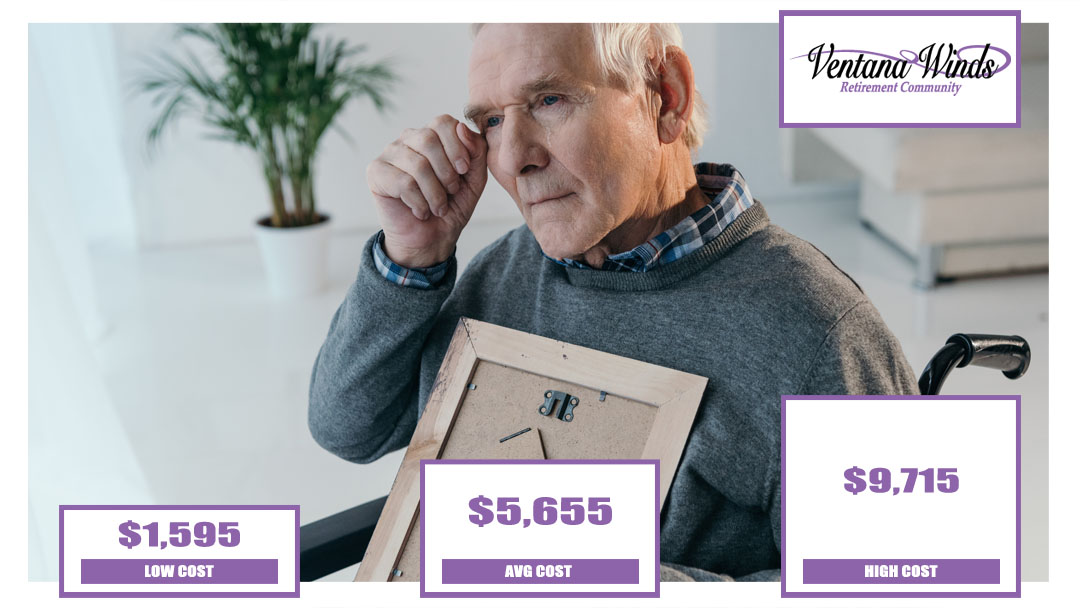

Memory Care In Youngtown, Arizona

There isn’t a more appropriately named setting for this lively community than Youngtown! Monthly rent at Ventana Winds includes three well balanced meals plus snacks, 24-hour staff, and a daily tidying of your apartment. The offerings don’t end there! Personal laundry is done weekly, transportation is provided for appointments or shopping, a 24/7 emergency call system is in place, as well as a full slate of exciting activities. Check out all of Ventana Winds’ offerings today!

Memory Care Package:

- Three meals per day plus snacks

- 24-hour care

- Diverse program of activities

- Transportation to appointments

- Bathing and oral care

- Dressing and grooming

- Daily tidying of your apartment

- Laundry service

- Weekly deep cleaning of your apartment

- All utilities, including cable TV